Metis (METIS) has experienced a 97.3% decline from its all-time high of $323.00 in January 2022 to approximately $8.67 as of November 2025. This dramatic collapse, combined with negative community sentiment and slow ecosystem adoption, raises legitimate questions about the project’s viability. However, the decline is not indicative of a rug pull or coordinated fraud scheme, but rather reflects fundamental challenges in adoption, execution, and competition within the Layer 2 landscape.

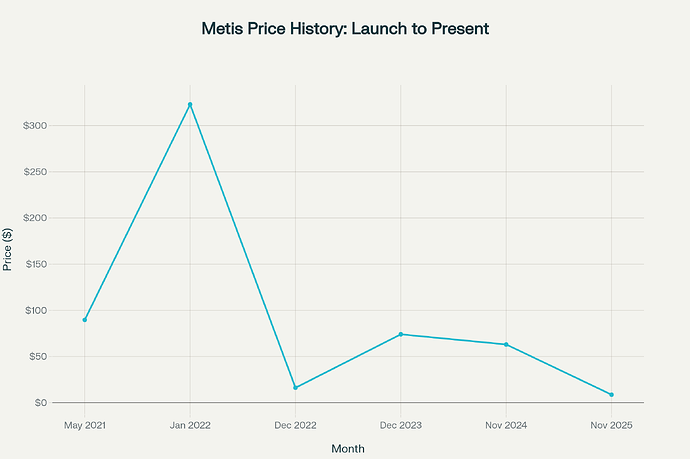

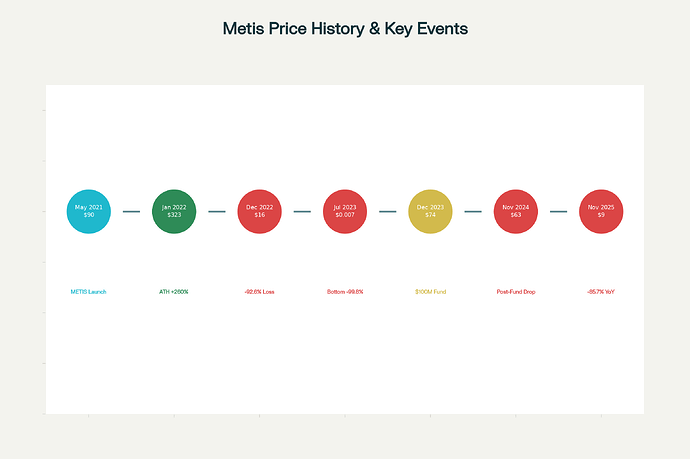

Metis Token Price History (May 2021 - November 2025)

Price History: From Launch to Present

Launch to Peak (May 2021 - January 2022)

Metis launched in May 2021 with an initial price of $89.67 before rapidly ascending to its all-time high of $323.00 in January 2022 a remarkable 260% gain in just 8 months. This early surge was driven by the Layer 2 narrative and the broader 2021 cryptocurrency bull market.

The Collapse (2022-2023)

The most devastating period occurred in 2022, when METIS crashed from $218.48 (end of 2021) to $16.15 by the end of 2022 a staggering 92.6% decline in a single year. This was followed by an equally volatile 2023, where the token bottomed at $0.00717 in July 2023 before recovering to $74.07 by year-end.

Current Status (2024-2025)

Despite an attempted recovery to $63.04 in November 2024, the token has continued deteriorating throughout 2025, losing 85.7% of its value from the start of the year ($42.31) to November ($9.02). The current price of approximately $8.67 represents a 97.3% loss from the all-time high.

Why Is Metis Declining? The Fundamental Issues

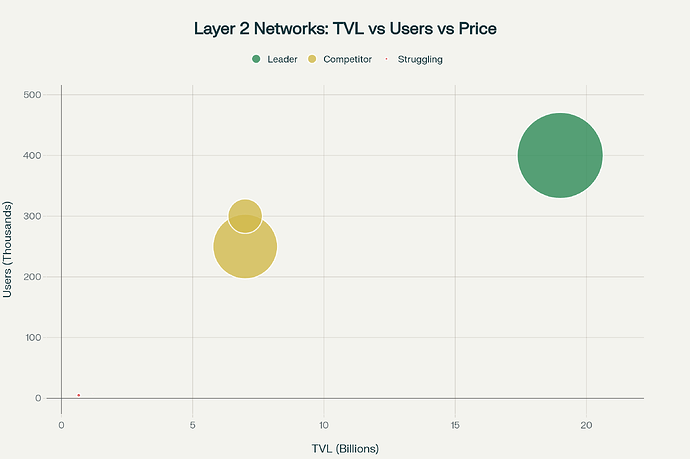

1. Severe Competitive Disadvantage in the Layer 2 Market

Metis faces insurmountable competition from more dominant Layer 2 solutions. As of mid-2024:

- Arbitrum: $19 billion TVL (Total Value Locked)

- Optimism: ~$7 billion TVL

- Base: ~$7 billion TVL

- Metis: Significantly lower, with only $660 million reported in earlier analysis

The market clearly demonstrates that Layer 2 users and developers are gravitating toward Arbitrum, Optimism, and Base, leaving Metis far behind in adoption metrics.

2. Drastically Low Adoption and Network Activity

Despite being around for several years, Metis has failed to gain meaningful traction:

- Low TVL relative to competitors: While Arbitrum attracted approximately $9 billion in funds, Metis only achieved $660 million TVL a 13.6x difference

- Lack of compelling dApps: The ecosystem lacks innovative projects that would attract users to the network

- Protocol abandonment: Many protocols built on Metis have either shut down following exploits or abandoned active development during the bear market

- Artificial TVL concerns: Analysis from CoinGecko noted that roughly 50% of Metis’ reported TVL came from newly minted tokens, indicating inflated metrics rather than genuine ecosystem growth

3. “False Prosperity” Through Unsustainable Incentive Programs

Similar to the failed example of Boba Network, Metis relied heavily on incentive programs that created artificial growth:

- $100 million Ecosystem Fund launched in December 2023: This fund allocated 4.6 million METIS tokens to ecosystem development, sequencer mining, retroactive funding, and new projects. However, the fund’s effectiveness remains questionable

- Token price dilution concerns: The ecosystem fund represented additional token circulation that could pressure prices through dilution

- Short-term focused users: Incentive programs attracted users interested only in farming rewards rather than building sustainable applications

Case study: Boba Network experienced similar dynamics, with TVL splitting more than 3 times from its peak and the token price dropping 85.5% from ATH a pattern Metis is replicating.

4. Persistent Communication and Execution Problems

According to a January 2025 community proposal, the Metis Foundation faces critical issues:

- Communication failures: “Communication has been a persistent challenge for METIS since its inception, and it has not improved in recent months”

- Lack of clear vision: The foundation fails to provide steady, concise roadmap updates

- Poor accountability: The team appears to be “constantly scrambling to produce content” rather than operating strategically

- Community sentiment at all-time low: Early adopters are reportedly "considering leaving the network"

5. Limited DAC (Decentralized Autonomous Company) Adoption

Metis’ core differentiation strategy revolves around Decentralized Autonomous Companies (DACs) a unique governance model designed to enable organizations to operate on-chain. However:

- DACs have failed to gain mainstream adoption

- The feature remains largely experimental with minimal real-world usage

- Traditional enterprises have not embraced the DAC framework at scale

Community Sentiment: Why Followers Are FUDing

The negative sentiment across Metis social media isn’t coordinated FUD, but rather justified frustration from community members:

Key issues fueling negative sentiment:

- Poor project execution: The Metis team has consistently failed to meet roadmap commitments and communicate effectively

- Token value destruction: Holders watching their investments decline 97% naturally express frustration

- Lack of differentiation: Metis offers nothing compelling that other L2s don’t already provide better

- Dilution concerns: The $100 million fund and ecosystem mining programs are perceived as diluting existing holders

- Transparent governance frustration: Community members have publicly stated that accountability from the Metis Foundation is lacking

The 97% price collapse represents the market’s rational assessment that Metis cannot compete effectively in the crowded Layer 2 landscape. While the project remains technically legitimate and development continues, investor confidence has largely evaporated due to the team’s inability to execute on promises and communicate a clear path forward.

Metis L2 Network: Actions, Strategy & Q&A

The path forward involves: (1) Capturing the emerging AI+blockchain narrative before competitors do, (2) Reducing token dilution concerns through transparent governance, (3) Achieving genuine adoption metrics beyond artificially incentivized activity, and (4) Building strategic partnerships that drive real ecosystem utility.

The dual-chain strategy (Andromeda for general DeFi + Hyperion for AI) addresses a real market gap while competitors like Arbitrum, Optimism, and Base focus on general scaling, no major L2 has successfully positioned itself as AI-native . If executed properly, Hyperion could capture the entire emerging on-chain AI application category before Base or Arbitrum create competitive products.

challenges:

- Hyperion mainnet was supposed to launch in May 2025; current delays suggest execution struggles

- Creating genuine AI dApp momentum is harder than launching infrastructure

- Hyperion will face competition from specialized AI chains like Solana (already have AI agents ecosystem) and upcoming AI L2s from other projects

- Marketing hype means nothing without real developer traction

2. LazAI + Alith Integration: On-Chain AI Agent Framework

What it is: A decentralized AI infrastructure stack for building verifiable, on-chain AI agents with transparent data governance.

Key components:

| Component | Function |

|---|---|

| Alith | Client-side AI agent framework for developers |

| LazAI Client | Handles on-chain job execution and settlement on Hyperion |

| Verifiable AI Marketplace | Data submission, processing, and outcome validation on-chain |

| DAT Token Standard | Granular data assetization and ownership |

| iDAO Model | Community-led data governance |

This addresses a critical trust gap in AI systems traditional AI is opaque. LazAI makes AI decisions cryptographically verifiable on blockchain.

- AI-powered DeFi (risk modeling, portfolio optimization)

- Gaming AI (real-time decision making)

- Autonomous agents for on-chain operations

Current traction:

The HyperHack 2025 hackathon allocated $200,000 in prizes specifically for Alith integration projects, with winners including LazaiTrader, Haithe, and GM² Agent. This shows developers are actually building on the framework small but promising signal.

challenges:

- Nascent adoption: LazAI has a smaller community than established frameworks like LangChain

- Learning curve: Developers need Web3 knowledge on top of AI expertise

- Success tied to ecosystem: Unlike SingularityNET’s marketplace model, LazAI’s success is entirely dependent on Metis adoption

- First-mover disadvantage: Larger AI projects will eventually build their own on-chain solutions

3. Ecosystem Funding Programs & Community-Driven Support

MetisEDF (Ecosystem Development Fund):

| Element | Amount |

|---|---|

| Fund size | 4.6 million METIS tokens |

| Total value (at ATH) | ~$360 million (Dec 2023) |

| Duration | 10 years distribution |

| Focus areas | New project deployment, product development, Builder Mining, sequencer mining |

Round 1 Results (October 2024):

- Community participation rate: 40% of total pool (nearly double the typical 15-20% for crypto projects)

- Funded projects span: DeFi protocols, infrastructure tools, education, community initiatives

- Signal: Community members are literally co-investing in Metis ecosystem strongest indicator of grassroots confidence

Unlike top-down VC funding, high community participation suggests the grassroots still believes in Metis’ potential.

challenges:

- $100M+ funds have failed to move the needle before (see: failed Optimism incentives)

- Capital alone doesn’t create sustainable adoption

- Fund efficiency remains unproven unclear how much of deployment went to actual revenue-generating dApps vs. experimental projects

4. Strategic Partnerships with TradFi & Enterprise

Wilshire Indexes Partnership (June 2025):

| Partnership Element | Details |

|---|---|

| Partner | Wilshire, major indexing and portfolio design firm |

| Synergy | Metis Global Partners + Wilshire’s W+ platform |

| Use case | Custom index solutions, factor-based strategies |

| Market focus | Institutional investors, CIOs, outsourced CIOs |

institutional validation* major financial firms don’t partner with failed projects. Wilshire’s involvement signals that serious players believe Metis’ infrastructure has enterprise utility. This could drive:

- Institutional liquidity into Metis-based financial products

- Respectability in TradFi circles (important for regulatory confidence)

- Medium-term revenue streams from custodial/indexing products

Comparable success: Chainlink’s TradFi partnerships helped legitimize on-chain oracle infrastructure.

challenges:

- Partnerships are often symbolic rather than revenue-generating

- TradFi integration requires regulatory clarity Metis doesn’t have

- Few institutional investors will migrate assets to lower-tier L2s (they prefer Arbitrum’s $19B TVL for security/liquidity)

5. Decentralized Sequencer Leadership (Differentiation)

Metis’ unique advantage:

Metis was the first Ethereum L2 to decentralize its sequencer a significant technical achievement. This addresses:

- MEV (Maximal Extractable Value) fairness: Prevents any single sequencer from front-running transactions

- Single-point failure prevention: Network survives if one sequencer fails

- Community-aligned incentives: Sequencer earnings distributed to network validators

While other L2s are still using centralized sequencers, Metis already solved this. a genuine technical moat that should matter to security-conscious developers and institutions.

challenges:

- Sequencer decentralization is table-stakes, not differentiating anymore Arbitrum and Base are also moving toward decentralization

- Doesn’t directly drive adoption if dApps and users don’t care about MEV fairness

- Solana and other high-throughput chains don’t decentralize sequencers but still have massive adoption

Severely challenged because:

- 97% price decline from ATH is genuinely catastrophic

- Lost 93%+ market share race vs. Arbitrum, Optimism, Base

- Ecosystem adoption metrics lag far behind competitors

- Opportunity cost for early investors is enormous (capital would have 10x’d on Arbitrum instead of 97% down on Metis)

- Execution track record shows consistent overpromise + underdeliver (Hyperion mainnet was promised for May 2025, still unclear if it’s live as of November 2025)

Verdict: Metis is a legitimate but severely distressed project with a low probability of recovery (15-20%) but nonzero path forward if Hyperion succeeds.

| Action | Status | Likelihood of Success | Impact if Successful |

|---|---|---|---|

| Hyperion AI-Native Chain | In progress (testnet done, mainnet launch murky) | 35% | Very high could capture AI narrative |

| LazAI + Alith Integration | Early adoption with HyperHack winners | 40% | High if developers keep building |

| HyperHack Hackathon | Completed Sept 2025, 10+ projects winning | 25% | Moderate hackathon projects have low conversion |

| Ecosystem Funding Program | Round 1 completed with 40% community participation | 30% | Moderate capital alone insufficient |

| Wilshire Partnership | Announced June 2025 | 35% | Moderate TradFi integration is slow |

| Decentralized Sequencer | Already achieved, unique advantage | 50% | Moderate table-stakes now, not differentiating |

| Overall (reaching $50+) | 8-12% | Requires near-perfect execution + market tailwinds |

Metis L2 Network: Comprehensive Visual Analysis

This visual guide breaks down the Metis strategy and current state across 12 key diagrams, providing intuitive understanding of the complex dynamics facing the project.

1. Price Timeline: From Launch to Crisis

Metis Price Timeline: From Launch to Current Decline

This timeline shows the complete price journey: launch at $89.67, meteoric rise to $323 ATH, catastrophic collapse to $0.00717, and current $8.67 price. Key insight: the 2022 bear market created a 92.6% loss in a single year the critical moment where Metis’ ecosystem began fragmenting.

2. Layer 2 Competitive Landscape

Layer 2 Network Competitive Position: TVL, Users, and Token Value

The bubble chart starkly illustrates why Metis is losing: Arbitrum commands $19 billion TVL with 400K daily users, while Metis has only $660 million TVL and 5K users. This 28x disadvantage in capital and 80x disadvantage in users explains the price decline rational market exit rather than fraud.

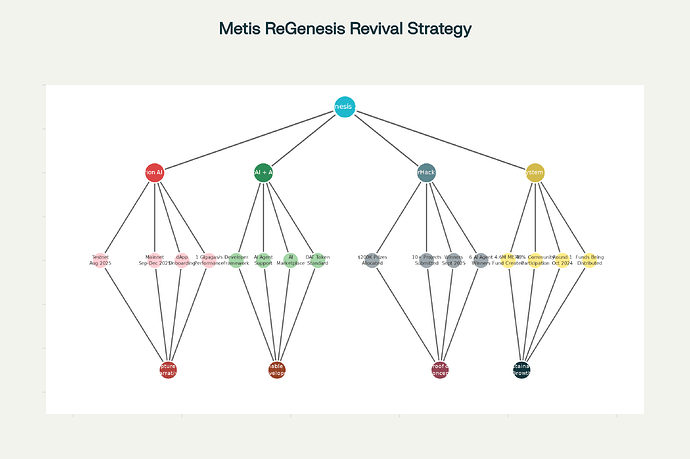

3. ReGenesis Strategy: Four-Pillar Framework

Metis ReGenesis Strategy: Four-Pillar Framework

- Hyperion AI Chain (in progress): High-performance infrastructure specifically optimized for AI workloads

- LazAI + Alith (active): Developer framework for building verifiable on-chain AI agents

- HyperHack Hackathon (completed September 2025): Proof of developer interest with 10+ projects submitted

- Ecosystem Funding (active distribution): $100 million allocated across community and development initiatives

The strategy is coherent: build infrastructure → attract developers → seed projects → create network effects.

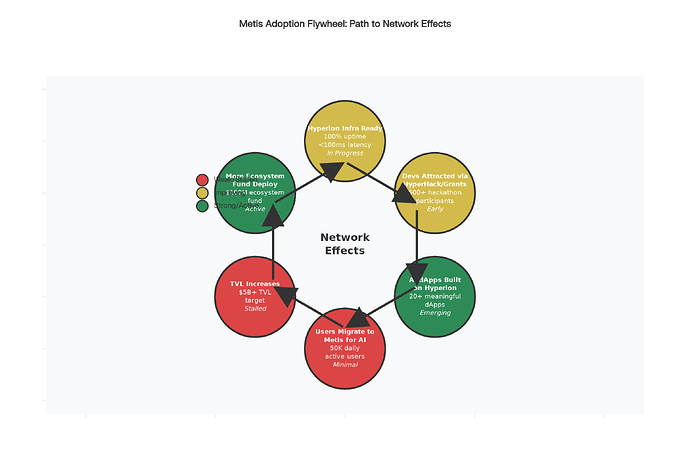

4. Adoption Flywheel: The Virtuous Cycle

Metis Adoption Flywheel: Virtuous Cycle for Network Effects

This flywheel diagram shows the intended growth pattern: Infrastructure Ready → Developers Attracted → dApps Launched → Users Migrate → TVL Increases → More Funding → Infrastructure Enhancement.

Critical vulnerability: The flywheel is currently broken at stage 3-4 (dApps to users conversion). Having infrastructure and hackathon winners doesn’t guarantee users will migrate.

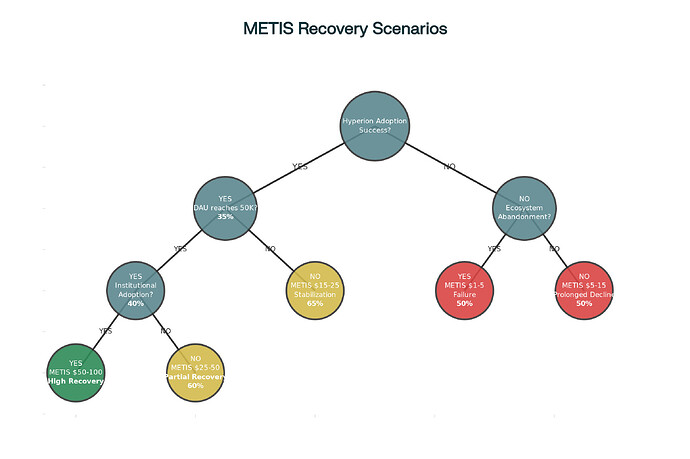

5. Recovery Scenarios: Decision Tree

Metis Recovery Scenarios: Decision Tree with Probabilities

This decision tree maps out the conditional probabilities for different outcomes:

- Best case (8-12% probability): Hyperion achieves 50K DAU → institutional adoption → $50-100 recovery

- Base case (35% probability): Moderate adoption (10-50K users) → $15-25 stabilization

- Worst case (50% probability): Low adoption (<10K users) → community abandonment → $1-5 collapse

The tree reveals why recovery is unlikely: each success gate has <50% probability, and all must clear for meaningful recovery.

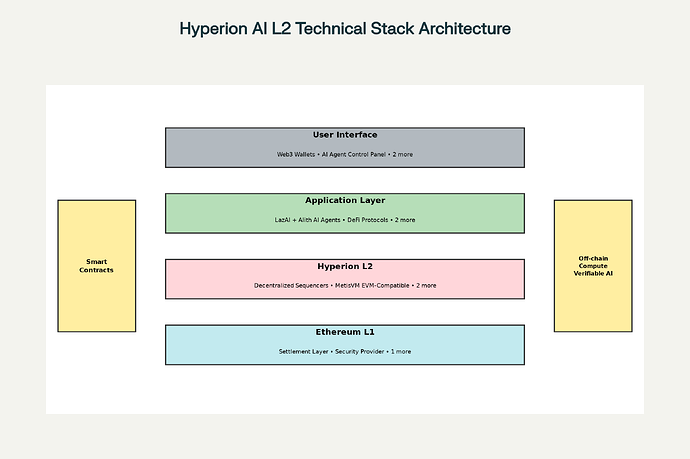

6. Hyperion Technical Architecture

Hyperion AI Layer 2: Complete Technical Architecture

The layered architecture shows Hyperion’s stack from Ethereum L1 settlement through the AI-optimized Metis L2 to AI agent applications.

- MetisVM: EVM-compatible but with AI-specific instruction sets

- Decentralized Sequencers: No single point of failure

- Parallel Execution: Multiple AI computations simultaneously

- 1 Gigagas throughput: Sub-millisecond finality for AI operations

Reality check: Technical sophistication doesn’t guarantee adoption but lack of it guarantees failure.

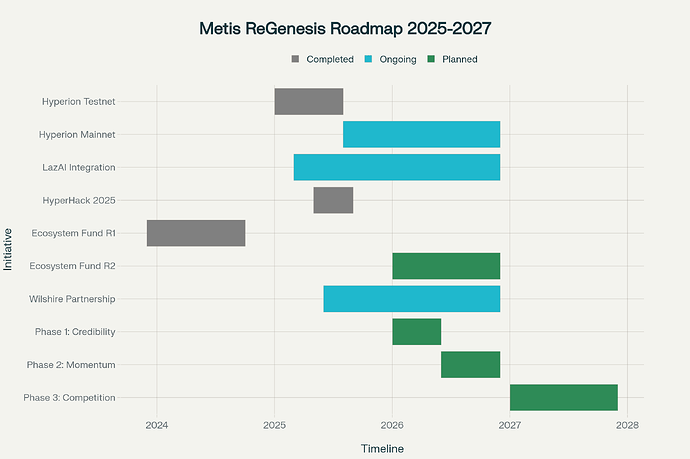

7. ReGenesis Roadmap: 2025-2027 Timeline

Metis ReGenesis Roadmap: 2025-2027 Timeline

- Completed (gray): Hyperion testnet, HyperHack, Ecosystem Fund Round 1

- Ongoing (blue): Hyperion mainnet upgrades, LazAI integration, Wilshire partnership

- Planned (green): Ecosystem Fund Round 2, three recovery phases through 2027

Key observation: Hyperion mainnet was promised for May 2025; November 2025 status unclear execution delays are already hampering confidence.

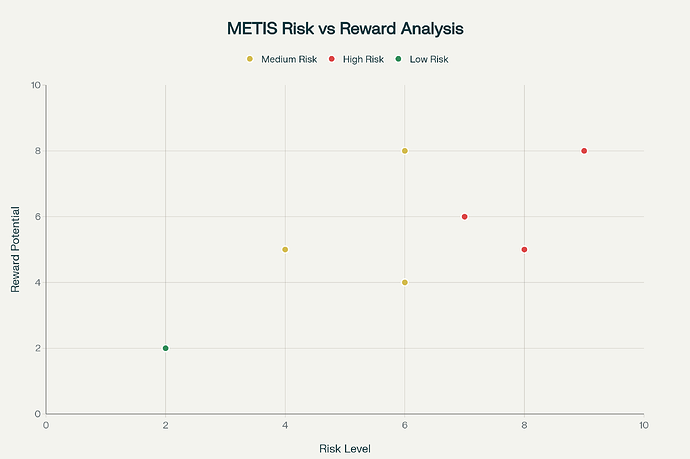

8. Risk vs. Reward Matrix: Investment Scenarios

Metis Risk vs. Reward Matrix: Investment Scenarios

| Quadrant | Scenario | Recommendation |

|---|---|---|

| High Risk/High Reward | Buy at current price, Short against | Speculation only |

| Medium Risk/High Reward | Become Hyperion developer, Ecosystem participation | Best risk/reward |

| Low Risk/Low Reward | Wait for adoption proof, Hold cash | Defensive |

| High Risk/Low Reward | N/A | Avoid |

| Insight: The “smart” move is becoming a Hyperion developer if you believe in AI narrative, not just buying the token. |

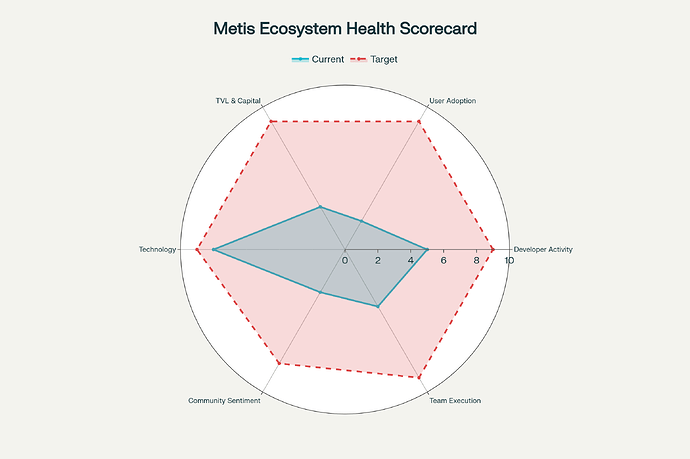

9. Ecosystem Health Scorecard: Strengths vs. Weaknesses

Metis Ecosystem Health Scorecard: Strengths vs. Weaknesses

The radar chart reveals Metis’ critical imbalances:

| Dimension | Current | Target | Gap |

|---|---|---|---|

| Technology | 8/10 | 9/10 | Small (Hyperion is good) |

| Developer Activity | 5/10 | 9/10 | Large (HyperHack helping) |

| User Adoption | 2/10 | 9/10 | Critical |

| TVL & Capital | 3/10 | 9/10 | Critical |

| Community Sentiment | 3/10 | 8/10 | Critical |

| Team Execution | 4/10 | 9/10 | Critical |

Metis has great technology but failing on every adoption and execution metric technology alone doesn’t win in crypto.

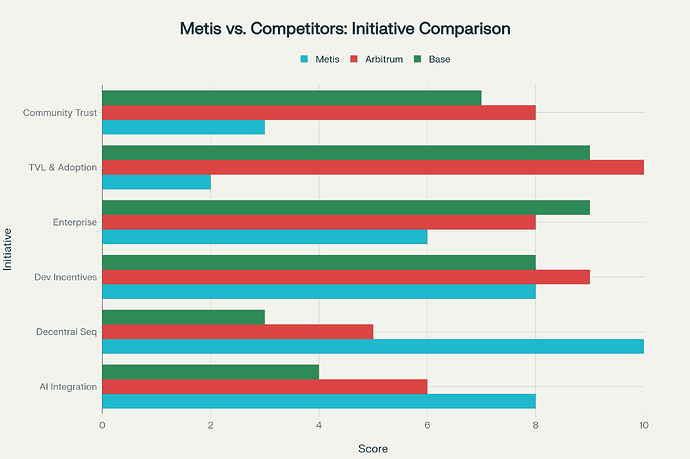

10. Competitive Initiative Comparison

Metis vs. Competitors: Initiative Strength Comparison

Head-to-head comparison shows where Metis leads and where it’s decisively behind:

| Initiative | Metis | Arbitrum | Base | Winner |

|---|---|---|---|---|

| AI Integration | 8/10 | 6/10 | 4/10 | Metis |

| Decentralized Sequencer | 10/10 | 5/10 | 3/10 | Metis |

| Developer Incentives | 8/10 | 9/10 | 8/10 | Arbitrum |

| Enterprise Partnerships | 6/10 | 8/10 | 9/10 | Base |

| TVL & Adoption | 2/10 | 10/10 | 9/10 | Arbitrum |

| Community Trust | 3/10 | 8/10 | 7/10 | Arbitrum |

| Insight: Metis has technological advantages in AI and sequencer design, but these don’t matter if users trust and use Arbitrum more. |

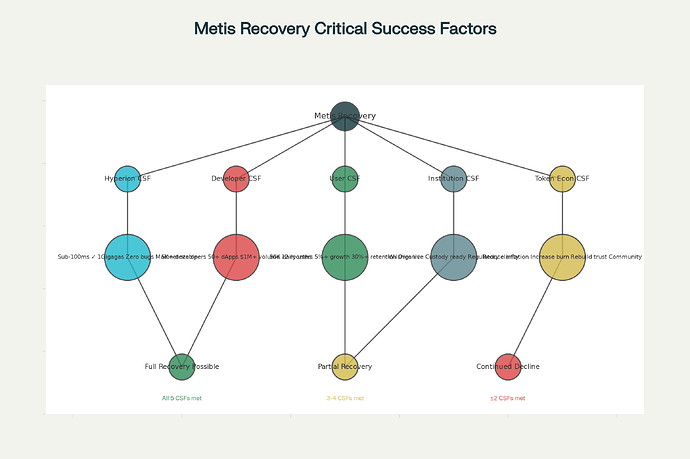

11. Critical Success Factors: Recovery Prerequisites

Metis Critical Success Factors: Recovery Prerequisites

For meaningful recovery, Metis must achieve all five CSFs:

- Hyperion Technical CSF: <100ms latency, 1Gigagas throughput, zero critical bugs, 24/7 uptime

- Status: 80% (mainnet upgrades planned Q4 2025)

- Developer Ecosystem CSF: 5K+ developers, 50+ dApps, $1M+ monthly volume, high retention

- Status: 30% (HyperHack winners showing promise but unproven)

- User Adoption CSF: 50K DAU, 5%+ monthly growth, 30%+ retention, organic growth

- Status: 10% (only 5K current DAU)

- Institutional CSF: Wilshire products live, custody solutions, regulatory clarity

- Status: 20% (Wilshire partnership exists but not generating revenue)

- Token Economics CSF: Reduced inflation, buybacks, community trust, transparency

- Status: 5% (no token burn program announced)

Need 3-4 of 5 for partial recovery; all 5 for full recovery. Current trajectory suggests 1-2 will be achieved.

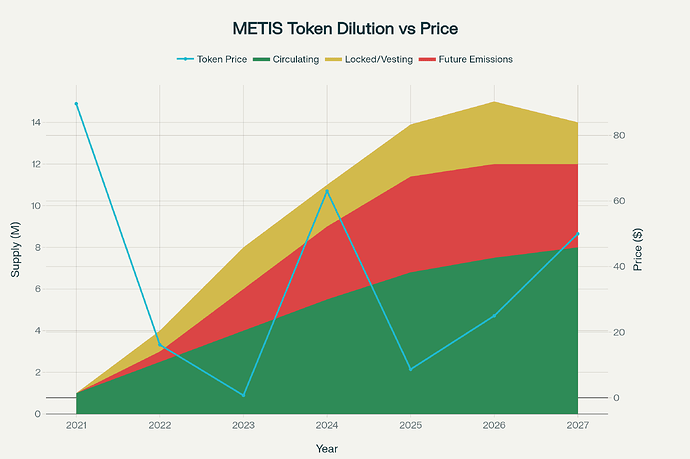

12. Token Dilution vs. Price Pressure

METIS Token Dilution Analysis: Supply Pressure on Price

The stacked area chart shows supply dynamics:

- Circulating supply growth: 1M (2021) → 6.8M (Nov 2025) → 8M target by 2027

- Locked/Vesting tokens: 4.6M ecosystem fund creating future selling pressure

- Future emissions: Community mining and sequencer rewards will add 2-3M more tokens

Economic reality: Even if adoption stays flat, token supply increases 15-20% annually creating structural downward price pressure. Recovery requires adoption growth to exceed emission growth.

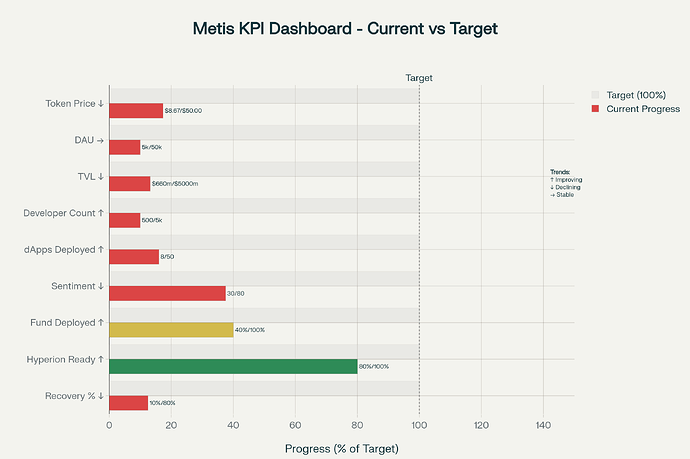

13. KPI Dashboard: Current State vs. Recovery Targets

Metis Key Performance Indicators: Current State vs. Recovery Targets

Critical Status (All red):

- Token price: $8.67 vs. $50+ target (82% shortfall)

- Daily users: 5K vs. 50K target (90% shortfall)

- TVL: $660M vs. $5B target (87% shortfall)

- Community sentiment: 30/100 vs. 80/100 target (63% shortfall)

On-Track Status (Green):

- Hyperion readiness: 80% complete

- Ecosystem fund deployment: 40% (ramping up)

- Developer growth: Early positive trend

Overall probability: 8-12% Only in an optimistic scenario where all on-track initiatives succeed and critical gaps close.

Visual Summary: What These Diagrams Reveal

Metis’ Paradox:

- Strong technology (Hyperion, LazAI, decentralized sequencer) but weak adoption (5K users vs. Arbitrum’s 400K)

- Clear strategic vision (AI-native L2 positioning) but poor execution track record (Hyperion mainnet delays)

- Committed community (40% participation in funding) but negative market sentiment (-97% price from ATH)

- Real innovations (AI infrastructure) but no compelling reason for users to switch from Arbitrum/Optimism

Disclaimer: Establishes that the research is educational analysis only NOT financial advice, endorsement, or investment recommendation; analysis is speculative; reader holds responsibility. Commits to source disclosure, acknowledges accuracy limitations, and explains that honest assessment (not hype) better serves network growth. Confirms no affiliation with Metis Foundation, no conflicts of interest, no insider access pure independent analysis. Notes this is NOT legal/tax/regulatory advice; varies by jurisdiction; time-sensitive (Nov 4, 2025); shouldn’t be relied upon beyond 3 months. Explicitly states that genuine network support comes through identifying weaknesses and execution gaps not cheerleading. Readers acknowledge understanding risks, will consult professionals, and hold researchers harmless.