Artemis Finance

Artemis Finance is a liquid staking protocol designed exclusively for Metis Decentralised Sequencer Pools. Users can stake their METIS token on Artemis Finance and receive the liquid token - artMETIS.

Artemis offers METIS holders a streamlined opportunity to participate in the Decentralized Sequencer and earn profits. Simultaneously, participating users will receive a liquid wrapper called artMETIS, which automatically accumulates earnings. This single-wrapper mechanism provides a simpler and more unified user experience, eliminating the need for additional costs to incentivize liquidity across multiple wrappers. This approach makes it easier to build a robust DeFi usage scenario.

Website: https://artemisfinance.io/

Twitter: https://twitter.com/Artemisfinance

Artemis Advantages

- While earning staking rewards through participation in the Decentralized Sequencer, users can maximize the efficiency of fund deployment by engaging in various activities on the Metis chain through artMETIS.

- The artMETIS, being yield-bearing and following a single-token model, promotes greater liquidity concentration and uniformity. Additionally, earnings are automatically reinvested, providing a more user-friendly experience.

- Rooted in community-driven principles, Artemis is set for a fair launch. In the future, Artemis Token holders can stake or lock their tokens to receive a share of the protocol-generated fees. Importantly, it serves as a crucial tool for protocol governance.

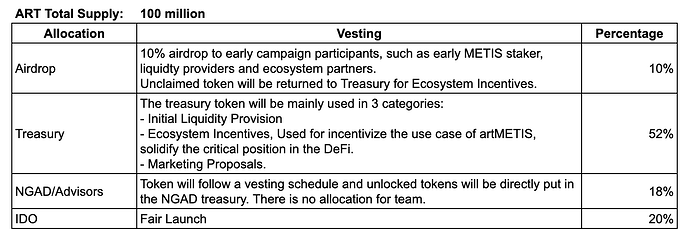

Tokenomics

Go-to-market Strategy

The strategy is designed to attract more participation in Metis staking while allowing users to leverage artMETIS in the versatile world of DeFi.

- Launching Campaign

We will be running a launching campaign to obtain market share and build a community of early adopters. A referral program and guild scheme will be introduced in the campaign. Participants who contribute to the campaign will earn loyalty points, which can be redeemed for IDO allocations and airdrop. - Strategic Partnerships

We will collaborate with DeFi projects, liquidity providers, and yield optimization platforms to increase liquidity and expand the user base. Our existing liquidity partners include Dewhales Capital (an anonymous DAO of top 100 debank addresses), AlfaDAO, and Benmo Labs. - Expanded Use Cases of artMETIS

- Launch artMETIS/METIS pool on DEXes with liquidity farming incentives;

- List artMETIS on Pendle and enable the yield trading;

- List artMETIS on lending protocol as eligible collateral.

Ecosystem Additions and Synergies

Artemis Finance is incubated and backed by NGAD, a foundation DAO dedicated to pioneering the future of asset growth and expanding the horizons of Liquid Staked Tokens ecosystems. NGAD’s other members protocols include Equilibria Finance and Euclid Finance, both will play pivotal roles in creating synergistic effects within the Metis Ecosystem and further bolster the growth of Artemis.

The following brief introductions to Equilibria and Euclid will provide a glimpse into their instrumental roles and value propositions. For more details, please visit the attached links.

Equilibria Finance: Growth Engine for LSDFi

Equilibria is a protocol built on top of Pendle Finance and is designed to enhance the yields of LPs through the accumulation of vePENDLE tokens. The main goal is to create a win-win scenario where all participants benefit, making yields more attractive and accessible to a broader range of users. It has reached a TVL exceeding $100M and is now available on Ethereum, Arbitrum, BNB Chain and Optimism.

LSD-in-one and Growth Engine

Equilibria is committed to expanding its offerings by integrating and promoting high-quality LSD and LRT assets. By assisting these assets in gaining traction within the liquidity landscape, Equilibria aims to accelerate their growth and, in doing so, enhance the broader DeFi ecosystem.

We believe our presence serves as a flywheel in value creation across the LSD ecosystem, by maximising capital efficiency and aligning economic incentives across all market players.

Website:https://equilibria.fi/

Twitter: https://twitter.com/Equilibriafi

Defillama: https://defillama.com/protocol/equilibria

Euclid Finance: New Standard for Ethereum Restaking

Euclid Finance is a comprehensive solution that simplifies the restaking process, offers an omnichain liquid asset (elETH) representing restaked positions, and establishes a trustless and permissionless operator network. Euclid aims to enhance the accessibility, security, and decentralization of EigenLayer.

Euclid has two major features that set it apart from other protocols:

1. elETH is a omnichain liquid asset

elETH is a yield-bearing liquid wrapper representing the restaking position. With Euclid, users can deposit their ETH and LSTs from different networks without worrying about bridging or gas fees.

2. Trustless and Permissionless Operator Network

Euclid enables restakers to delegate their assets to various operators. Operators must stake ECL (Euclid’s governance token) and restake ETH/LST independently, which then serve as security deposits, ensuring the operators’ eligibility and competence in fulfilling their responsibilities. This mechanism not only protects restakers’ interests but also incentivizes operators with ECL staking rewards and commission earnings from restakers.

Website: https://euclidfinance.io/

Litepaper: Litepaper | Euclid Finance

Twitter: https://twitter.com/Euclidfi

Conclusion

Artemis Finance stands ready to create a profound impact within the Metis ecosystem. With a clear vision to empower the decentralized sequencer and expand the use case of METIS, we are driven to catalyze the widespread adoption of liquid staked METIS. We are excited about the potential of Artemis Finance and will continue contribute to the continued growth and development of the Metis ecosystem.

Looking forward to the possibility of working together to bring Artemis Finance’s vision to fruition.