Live Link: https://iyield.netlify.app

Project Name

iYield– DeFAI Smart Vaults

Problem Statement

Yield farming in DeFi is complex, resource-intensive, and often inaccessible to non-expert users. Retail investors struggle to keep up with rapidly changing market conditions and protocols, leading to suboptimal yield and high risks. There’s a need for a system that automates intelligent yield allocation while remaining transparent, secure, and accessible.

Solution Overview

iYield is an on-chain AI-powered vault protocol that automates capital allocation across yield strategies. Leveraging Hyperion’s parallel execution and on-chain AI capabilities, iYield dynamically rebalances funds across multiple DeFi protocols to optimize returns. Our system democratizes advanced yield optimization, removing the barrier of technical know-how while ensuring transparency and performance. By bringing AI workflows directly on-chain, iYield introduces fully verifiable, trustless DeFi asset management for everyone.

Project Description

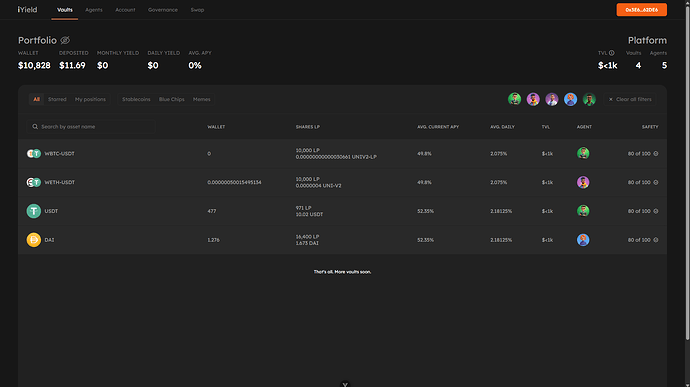

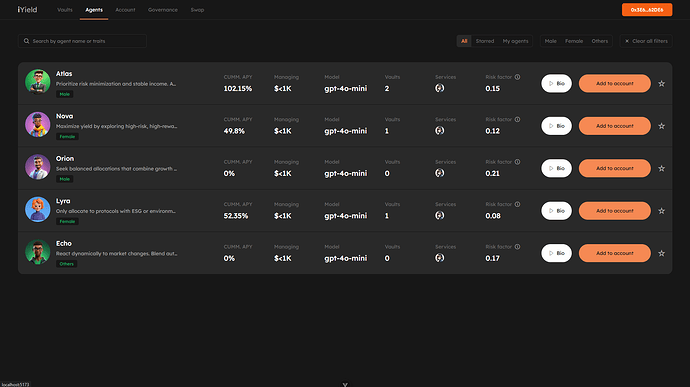

iYield is a modular DeFAI protocol offering Smart Vaults, AI-driven investment vaults that manage yield strategies in real-time. It uses a rebalancing engine built on on-chain AI models to evaluate yield rates, risk metrics, gas costs, and liquidity across various DeFi protocols. Users deposit into Smart Vaults, which then allocate funds automatically based on performance and risk profiles determined by the AI.

We plan to leverage Hyperion’s high-throughput parallel execution, real-time inference for LLMs, and Optimistic Rollup support to enable seamless AI decision-making directly on-chain. Core features will include vault creation, AI strategy selection, real-time performance analytics, and dynamic allocation. What excites us is the possibility of making DeFi investment smarter, faster, and fairer thus empowering users with minimal effort and maximum transparency.

Community Engagement Features

To incentivize engagement, iYield will integrate a gamified testnet experience:

Testable Tasks: Deposit into a Super Vault, simulate a rebalancing operation, vote on a community strategy proposal, and complete an educational quiz.

Points System: Each task earns users points (e.g., Deposit = 20 pts, Rebalance Sim = 30 pts, Vote = 15 pts, Quiz = 10 pts).

Gamification Mechanics: Leaderboards, NFT badges for milestones, and early-user rewards tied to accumulated points.

Getting Involved

Community members can join via:

Discord/Telegram: Contribute feedback, ideas, and test features.

GitHub: Collaborate on smart contract development or audit code.

Content Creation: Help with educational materials, documentation, or translations.

Early Access: Sign up as a beta tester to help shape iYield and earn rewards.

MORE INFO SOON