Abstract

This proposal advances Metis’ next phase of ecosystem alignment - strengthening the bridge across all network layers (Andromeda, Hyperion, LazAI, ZKM, GOAT) through refined token flows and unified incentives that reward real usage. It formalizes two interlinked upgrades:

Optimizing DSeq sustainability (20% → 15%) and establishing the Ecosystem Alignment & Growth Reserve (EAGR) to power validator expansion, liquidity depth, and cross-layer participation - without new issuance or inflation.

Background

Current State

Since ReGenesis, Metis has operated on a consistent architectural principle: fortify the base infrastructure first, enable high-performance applications, and ensure that generated value flows back to the ecosystem. As outlined in Elena’s recent letter to the community ( Metis September Monthly Roundup: Hyperion Builders Make History - Metis ), our architecture includes:

-

Andromeda: Traditional EVM-compatible Layer 2 handling general settlement and foundational applications, including DeFi

-

Hyperion: Performance expansion layer providing elasticity for high-throughput, low-latency scenarios, including AI workloads

-

LazAI: Application and data layer converting AI × DAT scenarios into on-chain visible records that connect user actions with assetization paths

-

ZKM: Zero-knowledge and verifiable compute infrastructure as long-term primitives

-

GOAT: Bitcoin Layer 2 exploration derived from ZKM, philosophically aligned with Metis in turning verifiable compute and real usage into network value

These components represent different facets of a unified ecosystem in which network value returns to the Metis ecosystem through usage-driven, on-chain-visible mechanisms.

Unifying the Metis Ecosystem

The blockchain industry has seen major shifts lately. Market volatility has tested Layer 2 ecosystems, while AI’s rise has created new opportunities and pressures for infrastructure builders. Communities have voiced concerns about sustainability, resource efficiency, and the need for adaptive strategies that stay true to core principles.

Metis’ approach focuses on strategic alignment rather than reactive change, bringing the other network layers into closer alignment. Its integration of AI through LazAI and verifiable compute via ZKM reflects a long-term vision of usage-driven value creation—not short-term trend chasing. To realize this, Metis is refining its economic model to balance immediate incentives with long-term sustainability as it launches new network phases requiring validator and liquidity support.

Proposal Details

A key component of ecosystem unification is establishing METIS as the native gas token for the LazAI network. This represents the first step in unifying the ecosystem, creating direct, usage-driven demand in which every AI inference, data operation, and on-chain computation requires METIS. The EAGR will provide initial gas liquidity support and mechanisms to ensure a seamless user experience during network launch.

The two interconnected optimizations proposed below enable this ecosystem unification while maintaining long-term sustainability:

1. Decentralized Sequencer Mining Rewards Optimization

Current Parameter: 20% annualized mining rewards rate

Proposed Parameter: 15% annualized mining rewards rate

Rationale:

-

The Decentralized Sequencer pool has matured since launch, with established participation and operational stability

-

At 15%, Metis sequencer yields remain above leading L2 averages (e.g., Base, Arbitrum validator returns <10%), ensuring continued attractiveness while improving economic runway by 25%.

-

Optimizing the rate frees capital for broader ecosystem expansion and aligns incentives across upcoming network layers.

Implementation:

-

Smooth phased rollout to ensure continuity

-

Parameters and timeline will be determined to minimize disruption and adjusted as needed

-

Existing sequencer operations remain unaffected during the transition period

2. Establishment of Ecosystem Alignment & Growth Reserve (EAGR)

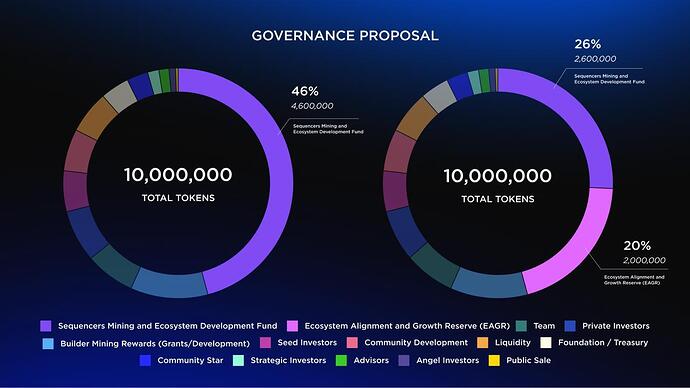

Size: 20% of total METIS supply (reallocated from existing Mining Rewards).

Source: Reallocation within the original tokenomics “Mining Rewards” toward growth

Critical Clarifications:

-

No new token issuance: EAGR represents a reallocation toward growth of already-allocated tokens

-

No change to total supply cap: The maximum METIS supply remains unchanged

-

Phased release model: Tokens convert to circulating supply gradually per specific use case activation

Community & Stakeholder Participation Paths & EAGR Example Use Cases (Whitelist-Based Execution):

-

Validator Staking for New Network Phases

-

Ecosystem Liquidity Support

-

Treasury Support for Ecosystem Sub-Projects

Governance and Execution:

-

Phased release per use-case activation

-

Whitelist-based allocation requiring documented usage justification

-

Implementation aligned with established governance procedures

Economic Impact Analysis:

-

Total supply: 10,000,000 METIS → 10,000,000 METIS (No change)

-

Circulating Supply: Dynamic → Dynamic (Phased per use case)

-

Demand-side offsets: Staking, locking, and real usage requirements create natural demand mechanisms

-

Inflation: None

Benefits to the Metis Ecosystem

For METIS Holders:

-

Improved long-term economic sustainability through balanced reward structures

-

Enhanced ecosystem growth potential through strategic capital allocation

-

Transparent resource management with clear accountability mechanisms

For Decentralized Sequencers:

-

Continued competitive rewards at a 15% annualized rate

-

Smooth transition, preventing operational disruption

-

Strengthened overall ecosystem supporting sequencer value proposition

For Ecosystem Builders:

-

Access to strategic support through EAGR mechanisms for qualified projects

-

Validator participation opportunities in emerging network phases

-

Aligned incentive structures promoting long-term ecosystem contribution

For the Broader Community:

-

Visible commitment to sustainable growth over short-term extraction

-

Infrastructure support for next-generation applications (AI, DAT, cross-chain)

-

Model resilience during market volatility

Implementation Roadmap

Phase 1 (Upon Approval): Governance vote completion and result announcement

Phase 2 (Within 2 weeks of approval):

-

Detailed technical implementation notice for DSeq rate transition

-

EAGR establishment

Phase 3 (Within 4 weeks of approval):

- DSeq rate smooth transition initiation

Phase 4 (Ongoing):

-

Validator participation program details release

-

Community feedback integration

-

Adaptive parameter adjustments through governance as needed

Voting Details

Proposal Type: Governance Proposal (modifies economic model parameters and tokenomics structure)

Voting Platform: Snapshot (https://snapshot.org/#/metislayer2.eth)

Voting Link: Governance Proposal: Metis Ecosystem Unification and Economic Model Evolution

Voting Timeline:

-

Monday, October 27: Proposal publication on governance forum, accompanying blog post announcement, and Snapshot vote initiation

-

Wednesday, October 29: Snapshot vote initiation

-

Thursday, October 30: Community Twitter Space for questions and clarifications

-

Monday, November 3: Vote conclusion (5-day voting period)

Voting Options:

-

Approve (support both DSeq rate optimization and EAGR establishment)

-

Reject (oppose the proposed changes)

-

Abstain

Quorum Requirements: Per the governance framework for Governance Proposals

Implementation Authority: Upon majority approval, the Metis Foundation will coordinate execution under guidance from community governance and validator feedback according to established governance procedures, with Governance Working Group oversight.

Official Links

-

Metis Foundation Governance Framework: Metis Foundation - Governance

-

Metis Developer Documentation: https://docs.metis.io

-

Decentralized Sequencer Overview: https://docs.metis.io/dev/decentralized-sequencer/overview

-

CEG Governance Forum: https://forum.ceg.vote

-

Snapshot Voting Platform: https://snapshot.org/#/metislayer2.eth

Disclaimer

Through this proposal, Metis affirms its belief that resilience is built, not bought. Every holder, validator, and builder who participates in this vote strengthens the bridge between purpose and value, lighting the way for the next phase of our collective journey.

This proposal does not constitute financial advice. Token holders should conduct their own research and evaluation before voting. Technical implementation details, specific parameters, and timelines are subject to refinement based on operational requirements. The final interpretation of governance outcomes is the responsibility of the Metis Foundation, in coordination with the Governance Working Group, per established governance procedures.