Introduction

Stablis Protocol revolutionizes decentralized borrowing on Metis by offering loans against yield-generating assets by introducing a non-custodial, efficient capital mechanism where loans are denominated in USDs, a stablecoin pegged to the US dollar.

Mission and Key Benefits

Our mission is to facilitate capital-efficient, user-friendly borrowing against yield-bearing assets like stMETIS. We offer significant advantages, including:

→ Low interest rates on loans

→ Low minimum collateral ratios starting at 125%

→ Liquidity re-utilization across DeFi protocols on Metis

→ STS stakers will earn 100% of protocol revenue

This enhances capital efficiency and also fosters a robust, secure borrowing environment.

Innovation and Community Value

Stablis extends the Liquity codebase to enable multiple collateral types and ensure a broad spectrum of Metis protocols can integrate seamlessly. Our dual-token system, featuring $USDs for stablecoin loans and $STS for protocol governance and revenue sharing, incentivizes both borrowers and stability providers. Our ecosystem fosters a participatory, secure environment for users, highlighted by our commitment to audits and non-custodial principles.

Core Features

Chests: A Chest is where you initiate and manage your loan. Each Chest is associated with a Metis address, and each address can only have one Chest per collateral type. If you are familiar with Vaults or CDPs on other platforms, Chests share a similar conceptual framework.

Chests maintain two balances: one consists of assets serving as collateral, and the other represents a debt denominated in USDs. You can modify the amounts of each by adding collateral or repaying debt. As you make adjustments to these balances, the collateral ratio of your Chest changes accordingly. You have the flexibility to close your Chest at any time by fully repaying your debt.

Stability pool: The Stability Pool acts as the primary safeguard in upholding system solvency. Its role is to act as the liquidity source for repaying debt from liquidated Chests, ensuring a consistent backing for the total USDs supply.

When a Chest gets liquidated, an amount of USDs equivalent to the remaining debt is burned from the Stability Pool, settling the debt. In return, the entire collateral from the liquidated Chest is transferred to the Stability Pool.

Stability Providers, who contribute USDs to the pool, fund the Stability Pool. Over time, Stability Providers experience a pro-rata reduction in their USDs deposits but gain a pro-rata share of the liquidated collateral. Given that Chests are likely to be liquidated just below the minimum collateral ratio, it is anticipated that Stability Providers will receive a greater dollar-value of collateral relative to the debt they settle. Any collateral received by Stability Providers is free to be traded back to USDs or other assets.

Redemption mechanism: We implement a redemption mechanism to support USDs’ $1 soft peg. As soon as USDs goes under peg, there is an incentive for arbitrage traders to buy USDs on the open market and redeem against collateral of the Chest(s) with the lowest collateral ratio. This arbitrage creates demand for USDs and brings it back to peg.

It’s the process of exchanging USDs for any collateral type asset at face value, where 1 USDs is always considered exactly worth $1. In this process, for x USDs, users receive x dollars worth of chest collateral in return. Users have the flexibility to redeem their USDs at any time without limitations.

STS Staking: From the moment users stake their STS in the staking vault, they will start earning real yield from the borrowing and redemption fees corresponding to their share of the total staked STS tokens at the moment the fees are generated. Also 100% of the interest fees will go directly to the STS stakers. Stakers have the flexibility to withdraw their staked assets at any time as there isn’t a lock-up period in place.

Governance: STS token holders are empowered with the right to cast their votes on important Stablis governance proposals. The main focus of these proposals will be to fine-tune borrowing fees and interest rates, ensuring that Stablis remains aligned with the ever-evolving market standards and rates. This dynamic governance structure is designed to keep our protocol competitive and responsive to the needs of our community.

What Stablis means for Metis

By leveraging the Metis blockchain we introduce a groundbreaking approach to unlocking more capital. It enhances the Metis ecosystem by enabling interest-free loans against yield-generating assets, thus promoting capital efficiency and financial inclusivity while significantly expanding Metis’ total value locked (TVL). Stablis’ integration into Metis not only diversifies the blockchain’s DeFi offerings but also attracts a broader user base seeking innovative, low-risk borrowing solutions. This symbiotic relationship fosters growth and stability within the Metis ecosystem, contributing to its overall value proposition and appeal to both developers and users.

$STS Tokenomics*

Max supply: 100M

- Community Incentives: 45.7M

- Airdrop: 0.3M

- Public Sale: 20M

- Team: 16M

- Advisors: 4M

- Treasury: 10M

- Initial liquidity: 4M (Locked)

*subject to change

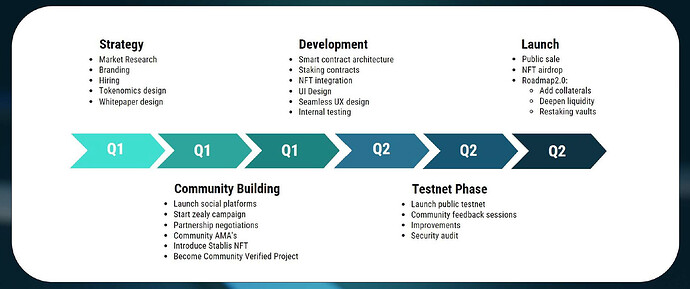

Pre-Launch Roadmap

Request for CVP Status

Given our innovative approach to DeFi on Metis, adherence to high security standards, and commitment to community engagement, we propose that Stablis be granted Community Verified Project status. This recognition will not only validate our efforts but also enhance our visibility and trust within the broader DeFi community.

We look forward to the feedback and are happy to provide any additional information required.

Conclusion

Stablis represents the forefront of LSD based borrowing solutions on Metis, with a focus on security, efficiency, and community empowerment. As such, we believe Stablis is an exemplary candidate for CVP status, promising to contribute significantly to the ecosystem’s growth and stability.

More Information

Website: ![]() Stablis

Stablis

Twitter: ![]() Stablis Protocol

Stablis Protocol ![]() (@StablisProtocol) on X

(@StablisProtocol) on X

Discord: Join the Stablis Protocol Discord Server!

Docs: ![]() General | Stablis docs

General | Stablis docs

Email: [email protected]